Using a Merchant Payment Solution is a great way to take your business to the next level. Not only does it offer you a simple and cost-effective way to accept credit card payments, but it also helps you stay compliant with the Payment Card Industry (PCI) and keeps your business safe.

Fees

Having a payment processing service can streamline your business operations. However, merchants must be aware of the fees that they will be charged. These fees can add up to a significant portion of your profits. Merchant Payment Solution is one of the growing businesses in the world now, as it makes your business flexible and gives a good customer experience.

Credit card processing fees vary based on the type of card being used, the risk level of the transaction, and the payment processor’s pricing model. The fees also vary depending on the volume of transactions that you process. Ultimately, the best pricing structure for your business will depend on the volume of transactions you process, the types of cards that you accept, and your typical monthly costs.

There are two main types of fees that Merchant Payment Solution charge: percentage-based and flat-rate fees. The percentage-based fees are based on the transaction amount and are typically charged at a percentage of the transaction amount. Some companies prefer flat-rate fees.

Other fees that are not directly related to credit card processing include startup fees, early termination fees, transaction fees, and additional surcharges. These fees can vary greatly from provider to provider.

Connecting to a payment gateway

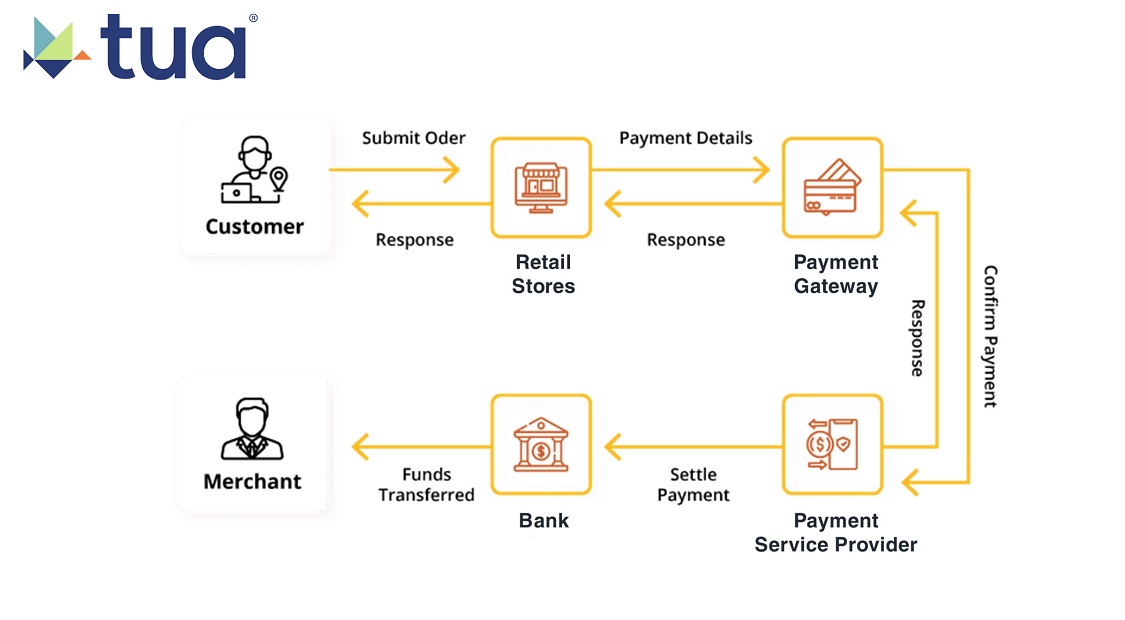

Whether you’re looking to set up a new business or Merchant Payment Solution, or you’re expanding an existing one, you’ll need to establish a payment gateway to receive online payments. A gateway is a software application that can be integrated into your e-commerce platform to make your business more efficient and secure.

Payment gateways enable businesses to accept credit cards, debit cards, and other forms of electronic payments. They also help reduce fraud risks.

The benefits of a Merchant Payment Solution and payment gateway are many, including ease of payment processing, reduced risk of fraud, and the ability to process payments across the globe. The key to choosing the right payment gateway for your business is to do your homework before signing up.

You’ll want to find a gateway that’s PCI compliant. This means that it can handle security and privacy issues to keep your customers’ information safe. You’ll also want to look into the type of products you’re allowed to sell. Some gateways will allow you to sell physical products, while others only provide services for digital products.

Delivering information through a payment processor

Getting the most out of your Merchant Payment Solution is a good way to increase revenue and improve customer satisfaction. A payment processor is a middleman that enables businesses to accept credit card payments and other financial transactions. These processors perform several functions, including transferring money from a customer’s bank to a merchant account. Choosing the right one can make a significant difference to your business’s bottom line.

One of the perks of using a payment processor is that it provides you with a variety of back-office support. These providers can also help you manage the risk involved in accepting payments online. They can also offer you ways to increase security, including client-side encryption.

The payment processor is also responsible for delivering the card information to the merchant account. This includes the cardholder’s name and other information, as well as the card’s value. During the transaction, the processor communicates with the card network to validate the security of the transaction.

PCI compliance

Whether you are a merchant accepting card payments or a payment service provider, PCI compliance is important to protect your business and your customers’ sensitive data. If your business is not PCI compliant, you may be subject to serious penalties. If you are a Merchant Payment Solution then you should go with its standards to work smoothly. PCI DSS (Payment Card Industry Data Security Standard) is a set of rules and procedures for the protection of cardholder data. This includes policies, procedures, and network architecture. If you wanted to know Who offers Tua? then you should read more about it.

PCI compliance applies to all businesses that store or process cardholder data. This information can be stored digitally or in a physical location. All cardholder data should be stored securely. In addition, cardholder data should be accessed only by individual credentials.

There are four levels of PCI compliance for merchants: PCI level 4, PCI level 2, PCI level 3, and PCI level 1. Each level has different reporting requirements, which can vary based on the number of transactions your business processes per year. PCI level 4 is for merchants with less than 20,000 transactions per year. These merchants are required to complete a self-assessment questionnaire (SAQ) and demonstrate compliance each year.